#1 LEI Issuer in the Nordic Countries

NordLEI is the leading authority in LEI issuance as the top LEI issuer in Denmark, Norway and Sweden.

Award-winning Performance

NordLEI was awarded the best-performing LEI Issuer in the Mid-Cap category for 2023 by the Global Legal Entity Identifier Foundation.

Quick, Efficient, Secure

We issue LEI numbers directly without any middle men. This means quick, efficient and secure delivery of your LEI code.

Search For LEI code

Latest LEI code registration

LEI Solutions & Partnerships

Being founded in 2014 NordLEI has helped more than 130 000 customers. With more than a decade’s experience, we at NordLEI have leveraged our extensive knowledge and developed a number of LEI-related solutions and partnership programs that help complex organizations, asset managers and banks with their unique needs.

Check out our different solutions and partnership programs below.

LEI Solutions

Partnerships

Articles and news regarding LEI codes

LEI number & LEI code: About the Legal Entity Identifier (LEI)

Definition and purpose of the LEI number

What is a LEI code?

A Legal Entity Identifier (LEI) is a 20-character alpha-numeric code. It's based on the ISO 17442 standard, developed by the International Organization for Standardization (ISO). It is designed to uniquely identify legal entities engaged in financial transactions globally. By providing a unique identifier for each entity, the LEI enhances the transparency of financial transactions, aiding in the management of financial data and reducing risk in the marketplace.

The role of LEIs in financial transparency and risk assessment

LEI numbers play a critical role in global financial markets by enabling clearer identification of transactional parties. This transparency facilitates various financial activities, including risk management, market surveillance, and regulatory reporting. The implementation of LEIs has been a response to the need for a universal standard that can prevent financial ambiguities and ensure that entities are easily and distinctly recognizable worldwide.

Significance of LEIs in Global Financial Markets

LEI numbers and their impact on international trade and finance

The adoption of LEIs has far-reaching implications for international trade and finance. It simplifies and streamlines counterparty identification, which is essential for a wide range of financial activities such as credit risk analysis, compliance checks, and transaction processing. LEIs are becoming increasingly important as regulators and financial institutions strive for greater levels of transparency and due diligence.

The Global LEI System (GLEIS): Structure and Function

Architecture of the Global LEI System

The Global LEI System operates through a three-tier structure designed to ensure the integrity and uniformity of the LEI data across the globe. At the top is the Regulatory Oversight Committee (ROC), which is responsible for upholding the governance principles of the LEI system and overseeing its operational integrity. The Central Operating Unit (COU), also known as the Global Legal Entity Identifier Foundation (GLEIF), manages the operational aspects of the LEI system, ensuring the quality and availability of LEI data. Local Operating Units (LOUs) are the entities authorized to issue LEIs to legal entities participating in financial transactions. They also maintain accurate and up-to-date information on the LEI registrants.

Function of the Global LEI System

-

Ensuring Consistency and Quality of LEI Data

The GLEIS is not just about assigning unique identifiers; it is also about ensuring that the data associated with each LEI is accurate and up-to-date. GLEIF and LOUs work together to maintain the quality of the LEI data pool, performing regular checks and validations to ensure that each LEI record reflects the correct information about a legal entity. This commitment to data quality is essential for the LEI's role in financial reporting, risk management, and regulatory oversight.

-

Facilitating Global Financial Communication

By providing a universal language for identifying legal entities, the GLEIS facilitates clearer and more efficient global financial communication. It enables financial institutions, regulators, and market participants to speak the same language when it comes to entity identification, reducing the potential for confusion and errors in financial transactions. This global standardization is crucial for managing and processing cross-border transactions, enhancing the ability of businesses and regulators to operate on an international scale.

How to obtain a LEI code

Steps to acquire a Legal Entity Identifier (LEI number)

-

Start by creating an account and fill in the following information:

The legal name of the entity, registration authority details, and the address of the headquarters. The reference data may be autocompleted as we use the local register to review your legal entity.

-

Validation of Entity Information

NordLEI utilizes the local register for automatic verification of submitted information. You have the option to choose a validation period of 1, 3, or 5 years. Throughout this chosen duration, your LEI will be renewed automatically.

-

The LEI is issued

Your LEI will be promptly issued following payment. The majority of LEIs are typically issued and delivered within a 2-hour window after the payment is processed. A receipt for this transaction will be sent directly to your email.

Documentation requirements for LEI number registration

In some circumstances we may contact you for additional documentation to complete your application. We will contact you via email and request the necessary documents to onboard your LEI code or alternatively you can upload these under ‘Documents’ when logged in.

Timeline for LEI Issuance

NordLEI endeavors to expedite the verification process, with most LEIs issued swiftly, typically within a few hours after payment has been received. The LEI is then catalogued in the global LEI database for public access.

Ongoing LEI number management

Routine LEI renewal and information verification

An LEI is subject to annual renewal with NordLEI to guarantee the data's validity. This critical process involves re-verifying the Legal Entity details and settling the renewal fee. Neglecting the renewal process may lead to the LEI being classified as 'lapsed', potentially impacting the Legal Entities financial activities.

LEI record amendments

Should any alterations occur in the entities legal status or other significant detailsdetails (name change, address changes etc). NordLEI requires prompt notification to update the LEI records accordingly. NordLEI emphasizes the importance of maintaining precise and current LEI information to uphold the Global LEI System's integrity and effectiveness. All alterations are cost-free and can be done via our Challenge function or emailing our Customer Support team.

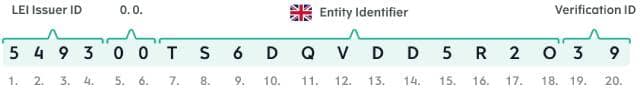

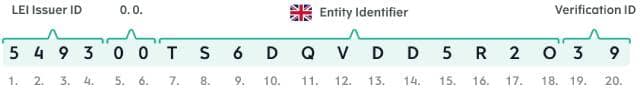

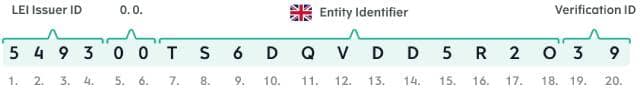

Composition and information of LEI codes

Anatomy of a LEI number

The LEI code is a 20-character alphanumeric string based on the ISO 17442 standard. The first four characters are the unique identifier of the LOU that issued the LEI. Characters 5-18 represent the entity-specific part of the code, which is unique to each legal entity and is assigned by the issuing LOU. The final two characters are check digits as per the ISO standard, which are used to validate the entire LEI.

Decoding the LEI number

Each segment of the LEI provides specific information about the legal entity. The LOU identifier ensures that there is no duplication of LEIs across different LOUs. The entity-specific section of the LEI is not constructed with identifiable information but is instead a series of characters that are unique to the entity within the LOU's system. The check digits at the end of the LEI provide a means to confirm the LEI's validity through a standardized algorithm.

Level 1 and Level 2 Data: Transparency in Entity Relationships

Each segment of the LEI provides specific information about the legal entity. The LOU identifier ensures that there is no duplication of LEIs across different LOUs. The entity-specific section of the LEI is not constructed with identifiable information but is instead a series of characters that are unique to the entity within the LOU's system. The check digits at the end of the LEI provide a means to confirm the LEI's validity through a standardized algorithm.

Level 1 Data: Who is Who

Level 1 data provides answers to the question “who is who”. This data includes the registered name of the legal entity, its registered address, and the country of formation. Level 1 data is designed to identify the legal entities engaging in financial transactions.

Level 2 Data: Who Owns Whom

Level 2 data answers the question “who owns whom” and provides information about the ownership and control structure of a legal entity. This includes the direct and ultimate parent companies of the entity, if applicable. Level 2 data is crucial for understanding the corporate hierarchies and tracing the entities' ownership structures, enhancing transparency in financial markets.

Interlinking of Global Entities through LEI Information

The LEI code is a 20-character alphanumeric string based on the ISO 17442 standard. The first four characters are the unique identifier of the LOU that issued the LEI. Characters 5-18 represent the entity-specific part of the code, which is unique to each legal entity and is assigned by the issuing LOU. The final two characters are check digits as per the ISO standard, which are used to validate the entire LEI.

Connecting Entities Across Borders

LEI data serves as a bridge connecting legal entities across the global financial ecosystem. It allows for the identification of entities in different countries and jurisdictions, facilitating cross-border transactions and regulatory reporting. The universal nature of the LEI enhances communication and reduces the risk of errors in the identification of entities.

Public Access to LEI Information

The LEI data is publicly accessible through the GLEIF database, which promotes transparency and allows various stakeholders, including investors, regulators, and the general public, to access and utilize this information. The availability of LEI data supports due diligence processes and aids in the assessment of counterparty risk.

Eligibility and Requirements for LEI number Acquisition

Legal Entities subject to LEI Registration

Legal Entity Identifiers are required for any legal entity that participates in financial transactions where reporting to financial regulators is a prerequisite. This includes but is not limited to companies, trusts, charities, partnerships, and government entities. The requirement for an LEI extends to entities involved in trading stocks, bonds, derivatives, and other financial instruments.

Jurisdictional and regulatory mandates

The mandate for an LEI can vary by jurisdiction and is often dictated by the regulatory framework in place. Entities should consult their local regulations or a compliance officer to understand if their activities necessitate registering for an LEI. If you need an LEI, you will in most cases be notified by your bank or broker.

LEI numbers: Costs and renewal procedures

Initial registration fees

A breakdown of the fees associated with obtaining and renewing an LEI, including any additional costs that might be incurred.

| LEI number / year | Price per year (Euro) |

|---|---|

| LEI number, 1 year | 99€ |

| LEI number, 3 years | 75€ |

| LEI number, 5 years | 65€ |

Yearly renewal fee

| LEI number renewal / year | Price per year (Euro) |

|---|---|

| LEI number, 1 year | 79€ |

| LEI number, 3 years | 65€ |

| LEI number, 5 years | 60€ |

Multi-year pricing

NordLEI offers a tiered pricing structure for LEI (Legal Entity Identifier) registration and renewal services, with discounts applied for longer commitment periods.

Procedures for the renewal of a LEI number

Detailed steps and best practices for renewing an LEI to ensure continuous compliance and validity.

Renewal Process and Maintaining Validity

LEI numbers are subject to an annual renewal process, which is essential to ensure that the LEI data remains current and accurate. The renewal process involves verifying the entity's information and paying a renewal fee. Failure to renew an LEI can result in its status being marked as 'lapsed', which may affect the entity's ability to participate in financial transactions.

Consequences of non-renewal

A LEI number that is not renewed on time can lead to regulatory reporting issues and potential operational disruptions. Entities may face difficulties in engaging with counterparties, and regulatory bodies might impose penalties or fines for non-compliance with LEI requirements.

Advantages of Legal Entity Identifiers for Entities

Global Recognition and Trust

A LEI number serves as a universal identifier that is recognized globally across financial markets. It establishes a level of trust and credibility for entities engaging in financial transactions, as it assures counterparties and regulators of the entity's legitimacy.

Mitigating Risk and Fraud

The use of LEIs contributes to the reduction of financial fraud by providing transparent and accessible data about legal entities. This transparency helps in the assessment of counterparty risk and the detection of potential fraudulent activities.

A LEI number, or Legal Entity Identifier, is a 20-character alphanumeric code that uniquely identifies legal entities participating in financial transactions worldwide. It is designed to improve the transparency of financial systems and enable better risk management.

Any legal entity that engages in financial transactions or operates within the financial markets may be required to have an LEI. This includes companies, trusts, charities, and government entities.

To apply for an LEI code, you must submit an application through a Local Operating Unit (LOU) like NordLEI that is accredited by the Global Legal Entity Identifier Foundation (GLEIF). The process involves providing accurate legal entity information and paying a fee.

LEIs must be renewed annually to ensure the associated legal entity data remains current and accurate. The renewal process is similar to the initial application and is handled by NordLEI.

An LEI includes details about an entity's structure and ownership, providing clear and authoritative information about its legal identity. Level 1 data includes the name and address of the entity, while Level 2 data includes information about the ownership and parent company structure.

The LEI code itself is a random sequence of characters and does not contain intrinsic information about the entity. However, the associated LEI reference data provides detailed information about the entity.

The Verifiable Legal Entity Identifier (vLEI) is a digital credential that provides a unique and cryptographically verifiable identity for legal entities like companies. It’s an updated version of the traditional Legal Entity Identifier (LEI), enhanced for the digital age to ensure secure and transparent online business interactions. Managed by the Global Legal Entity Identifier Foundation (GLEIF), the vLEI uses blockchain technology to allow for decentralized identity verification, fostering trust in the digital economy.

Read more about vLEI on these localized sites

Read more FAQ about lei codes

Sweden

Sweden Denmark

Denmark Norway

Norway Finland

Finland Faroe Islands

Faroe Islands United Kingdom

United Kingdom Ireland

Ireland Iceland

Iceland Luxembourg

Luxembourg Netherlands

Netherlands